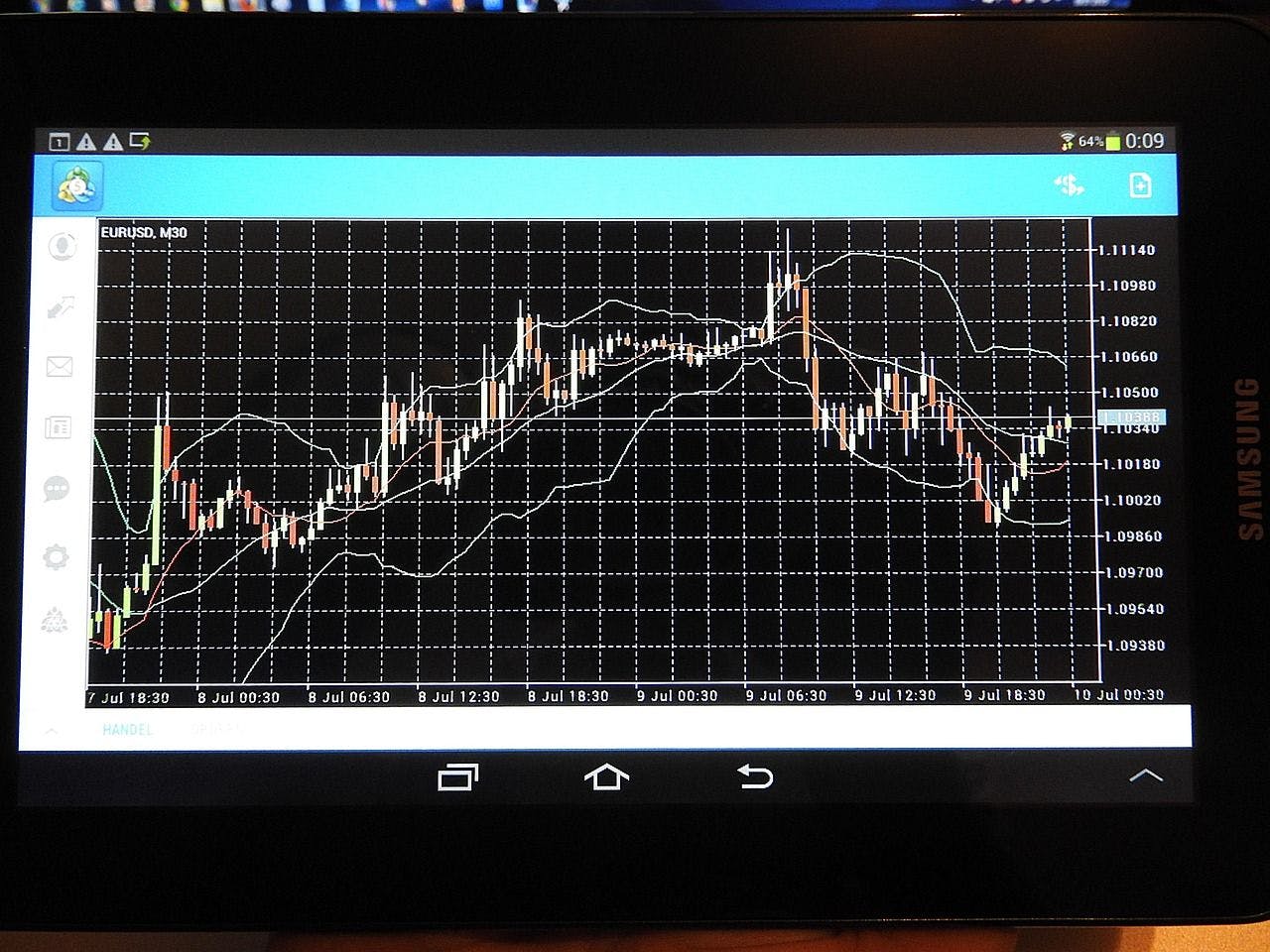

How Apple Stock Exposes the Limits of the Classic CAPM

4 Nov 2025

Discover how the asymmetric CAPM redefines market risk by factoring in investor position—revealing why Apple stock behaves differently for longs and shorts.

Twin‑Tower Neural Architecture for Δ‑Estimation in Differential Financial Models

4 Nov 2025

Neural networks act as adaptive parametric bases, improving hedging accuracy and reducing relative PnL variance versus classical methods.

Mathematics of Differential Machine Learning in Derivative Pricing and Hedging: Choice of Basis

4 Nov 2025

Drawing from Barron, Hornik, and Telgarsky, it proves neural networks yield superior efficiency in higher‑dimensional pricing tasks.

Constructing Loss Functions for Differential Machine Learning in Derivative Pricing

4 Nov 2025

A digital‑option example demonstrates the approach, using weak derivatives to recover sensitivity (∆) from discontinuous pay‑offs.

A Theoretical and Practical Framework for Differential Machine Learning in Derivative Pricing

4 Nov 2025

Theoretical results validate the algorithm’s efficiency and unify prior pricing models under a single differential‑learning formulation.

A Practical Guide to G-LSM: Improving High-Dimensional Option Pricing with Minimal Overhead

24 Sept 2025

Solving high-dimensional option pricing: G-LSM leverages Hermite polynomials and gradients to achieve a 10x accuracy boost over LSM.

The Price of Friction: How Transaction Costs Change the Strategic Trading Game

23 Sept 2025

This paper extends the Nash equilibrium model to markets with transaction costs, characterizing the solution via a system of FBSDEs.

Nash Equilibrium and Revealed Risk Exposure with Endogenous Price Impact

23 Sept 2025

We derive a closed-form Nash equilibrium where strategic investors alter market returns by revealing a different risk exposure than their true one.

Your Trades Move the Market: Rethinking Equilibrium When Every Order Has an Impact

23 Sept 2025

This work models a market equilibrium where investor price impact amplifies the effect of transaction costs, providing a closed-form solution.